How to Get the Best Price on a New Car

Understanding Car Pricing

How to get best price new car – Securing the best price for a new car requires a thorough understanding of how prices are determined. Several key factors influence the final cost, from the manufacturer’s suggested retail price (MSRP) to dealer markups and market conditions.

Factors Influencing New Car Prices

Numerous factors contribute to a new car’s price. These include the vehicle’s make and model, features and options, manufacturing costs, demand, and prevailing market conditions. Economic factors like inflation and material costs also play a significant role. For example, a luxury SUV will inherently cost more than a compact sedan due to its higher manufacturing cost and greater demand.

Manufacturer’s Suggested Retail Price (MSRP)

The MSRP is the price the manufacturer recommends for the vehicle. It’s a starting point for negotiations, but it’s rarely the final price paid. Understanding the MSRP allows buyers to assess the value proposition of a vehicle and compare it to similar models. The MSRP is prominently displayed on the vehicle’s window sticker and online listings.

Dealer Markups and Their Impact

Dealers often add markups to the MSRP, increasing the final price. These markups can vary significantly depending on factors like demand, vehicle popularity, and the dealer’s profit margins. High-demand vehicles, especially those with limited inventory, are more susceptible to significant markups. For instance, a popular electric vehicle model might see a markup of several thousand dollars above the MSRP.

MSRP Comparison of Similar Cars

The following table compares the MSRP of three similar mid-size sedans from different manufacturers. Note that features can significantly impact the final price.

| Manufacturer | Model | MSRP | Features |

|---|---|---|---|

| Toyota | Camry | $26,000 | Standard safety features, infotainment system, comfortable interior |

| Honda | Accord | $27,000 | Similar safety features, slightly upgraded infotainment, fuel-efficient engine |

| Nissan | Altima | $25,500 | Comparable safety and infotainment, sporty design |

Negotiating the Best Deal

Negotiating effectively is crucial to securing the best possible price. Preparation and a clear understanding of market value are essential components of a successful negotiation.

Effective Negotiation Strategies

Effective negotiation involves research, patience, and assertive but respectful communication. Buyers should come prepared with information about market value, competitor pricing, and available incentives. A willingness to walk away if the deal isn’t favorable can also strengthen one’s negotiating position. For example, knowing that a competitor offers a similar vehicle at a lower price provides leverage during negotiations.

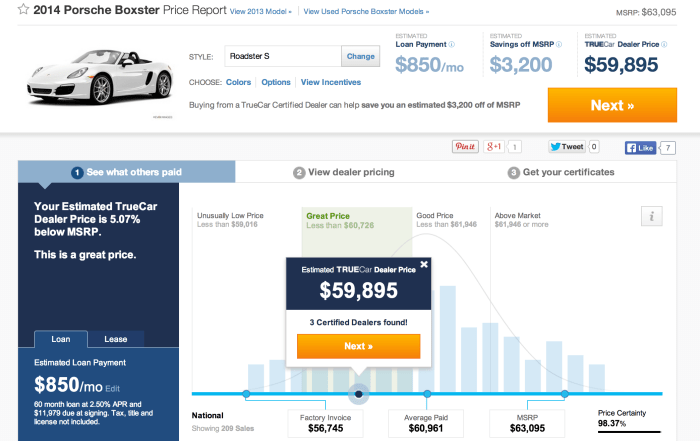

Researching Market Value

Before entering negotiations, researching the market value of the desired vehicle is paramount. Online resources and automotive pricing guides provide estimates of fair market value, helping buyers determine a reasonable offer. Websites and apps that provide detailed vehicle pricing data, considering factors such as mileage, condition, and options, are invaluable tools for this process.

Dealer Incentives and Rebates

Dealers often offer incentives and rebates to stimulate sales. These can include manufacturer rebates, financing incentives, and loyalty programs. Identifying and leveraging these incentives can significantly reduce the final price. Checking the manufacturer’s website and local dealer websites for current promotions is crucial.

Step-by-Step Negotiation Guide

- Research market value and identify desired vehicle.

- Contact multiple dealerships to obtain quotes.

- Negotiate the price, focusing on the out-the-door price.

- Explore financing options and negotiate interest rates.

- Review all documents carefully before signing.

Financing Options

Financing options significantly impact the total cost of a new car. Understanding the differences between loans and leases, and the factors influencing interest rates, is crucial for making an informed decision.

Loans vs. Leases

Auto loans allow buyers to own the vehicle outright after paying off the loan. Leases involve renting the vehicle for a specific period, with lower monthly payments but no ownership at the end of the lease term. The choice between a loan and a lease depends on individual financial circumstances and driving habits. For example, someone who frequently trades in vehicles might prefer a lease, while someone who plans to keep their vehicle for many years might opt for a loan.

Factors Affecting Interest Rates and Monthly Payments

Source: thelist.com

Several factors influence interest rates and monthly payments, including credit score, loan term, and prevailing interest rates. A higher credit score generally results in lower interest rates, while longer loan terms lead to lower monthly payments but higher total interest paid. Current economic conditions also influence interest rates, with higher rates during periods of economic uncertainty.

Impact of Loan Terms on Total Cost

Different loan terms significantly impact the total cost of the vehicle. A shorter loan term results in higher monthly payments but lower total interest paid, while a longer term leads to lower monthly payments but higher total interest. For example, a 36-month loan will have higher monthly payments than a 72-month loan, but the total interest paid over the life of the loan will be significantly less.

Questions to Ask Your Lender

- What is the annual percentage rate (APR)?

- What are the total finance charges?

- What are the terms of the loan?

- Are there any prepayment penalties?

Timing Your Purchase

The time of year you buy a car can impact the price you pay. Dealerships often have seasonal promotions and sales that can result in significant savings.

Optimal Time to Buy

Generally, the end of the year (November-December) and the end of the month are considered optimal times to buy a new car. Dealerships often push to meet sales quotas at these times, leading to more competitive pricing and incentives. The beginning of the new model year (late summer/early fall) is another potentially favorable time to buy, as dealers want to clear out the older models.

Seasonal Promotions and End-of-Month Sales

Dealerships frequently offer seasonal promotions and end-of-month sales to boost sales. These promotions can include discounts, rebates, and special financing offers. Keeping an eye on dealership websites and local advertising for these promotions is advisable.

Inventory Levels and Pricing

Inventory levels directly affect pricing and availability. When inventory is high, dealers may be more willing to negotiate prices to clear out stock. Conversely, low inventory can lead to higher prices and less negotiating room. Monitoring inventory levels at local dealerships can inform purchasing decisions.

Ideal Purchase Timeline

An ideal timeline for purchasing a new car would involve researching and comparing models several months in advance, followed by focusing on end-of-month or end-of-year sales to secure the best deal.

Exploring Additional Savings: How To Get Best Price New Car

Beyond negotiating the purchase price, several strategies can further reduce the overall cost of a new car.

Reducing Costs Beyond the Purchase Price

Trading in an existing vehicle can provide a discount on the new car purchase. Loyalty programs offered by manufacturers can also result in additional savings. Negotiating a lower interest rate on financing can significantly reduce the total cost over the life of the loan.

Obtaining the Lowest Interest Rates

Securing the lowest possible interest rates involves having a good credit score and shopping around for the best financing offers from different lenders. Pre-approval for financing can strengthen one’s negotiating position at the dealership.

Negotiating the best price on a new car often involves knowing the dealer’s cost. A crucial step in this process is understanding the vehicle’s true value, which you can achieve by learning how to find the dealer invoice price; check out this helpful guide on how to find dealer invoice price on new car to arm yourself with this vital information.

Armed with this knowledge, you’ll be better positioned to secure a fair and favorable deal for your new vehicle.

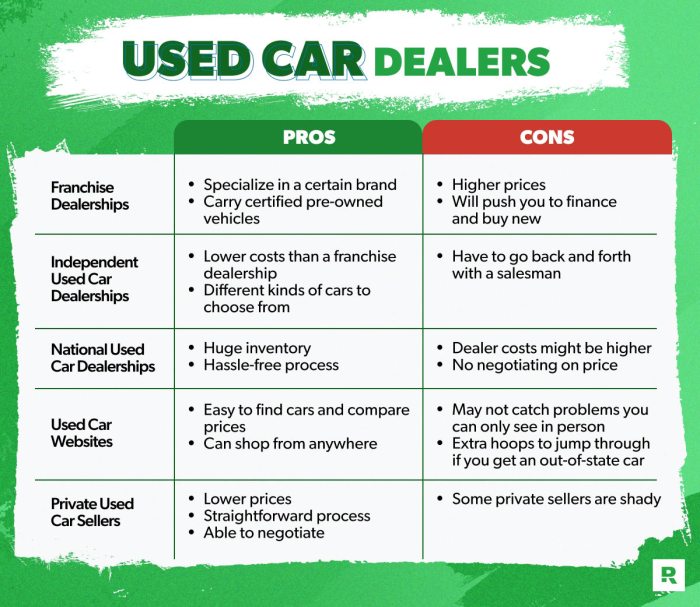

Leveraging Online Resources

Online resources, such as automotive pricing websites and comparison tools, can help buyers identify the best deals and compare prices from different dealerships. These tools can also provide information on available incentives and rebates.

Successful Negotiation Tactics

Source: carcrazydan.com

Successful negotiation tactics include being well-informed, being prepared to walk away, and focusing on the out-the-door price rather than just the vehicle price itself. Clearly stating your budget and desired terms can also aid in reaching a favorable agreement.

Understanding the Fine Print

Carefully reviewing all contracts and documentation is crucial to avoid hidden fees and potential problems.

Reviewing Contracts and Documentation

Source: ramseysolutions.net

Thoroughly reviewing all contracts and documentation, including the purchase agreement, financing agreement, and window sticker, is essential. Understanding all fees and charges, including destination charges, dealer fees, and taxes, is crucial to avoid unexpected costs.

Common Hidden Fees and Charges

Common hidden fees can include dealer prep fees, documentation fees, and other administrative charges. It’s important to negotiate these fees and clarify their purpose before signing any agreements.

Protecting Yourself from Scams

Buyers should be wary of high-pressure sales tactics and unrealistic promises. Checking the dealership’s reputation and verifying information with independent sources can help protect against potential scams.

Essential Documents Checklist

- Purchase agreement

- Financing agreement

- Window sticker

- Warranty information

Illustrative Example: A Detailed Car Purchase Scenario

Let’s consider a hypothetical car purchase scenario to illustrate the process and cost breakdown.

Hypothetical Car Purchase

Imagine a buyer is interested in a Toyota Camry with an MSRP of $26,000. After negotiation, the buyer secures a $2,000 discount, bringing the negotiated price to $24,000. Additional fees include a $500 dealer prep fee, $100 documentation fee, and $1,500 in sales tax. The buyer secures financing with a 5% APR over 60 months.

Cost Breakdown, How to get best price new car

- MSRP: $26,000

- Negotiated Discount: -$2,000

- Negotiated Price: $24,000

- Dealer Prep Fee: $500

- Documentation Fee: $100

- Sales Tax: $1,500

- Total Purchase Price: $26,100

- Financing Costs (estimated over 60 months): $3,000

- Total Cost (including financing): $29,100

FAQ Overview

What’s the best day of the week to buy a car?

The end of the month or quarter is generally considered a good time, as dealerships often aim to meet sales quotas. Weekdays are usually less busy than weekends.

How much should I put down on a new car?

The ideal down payment depends on your financial situation and loan terms. A larger down payment typically leads to lower monthly payments and less interest paid over the loan’s life.

Can I negotiate the interest rate on my car loan?

Yes, it’s possible to negotiate the interest rate, especially if you have good credit. Shop around for different lenders to compare rates and leverage competing offers.

What documents should I bring to the dealership?

Bring your driver’s license, proof of insurance, and pre-approval for financing if you have it. It’s also helpful to bring a list of your must-have features and a target price in mind.