New Car Insurance Price Calculator

Understanding User Needs and the New Car Insurance Price Calculator

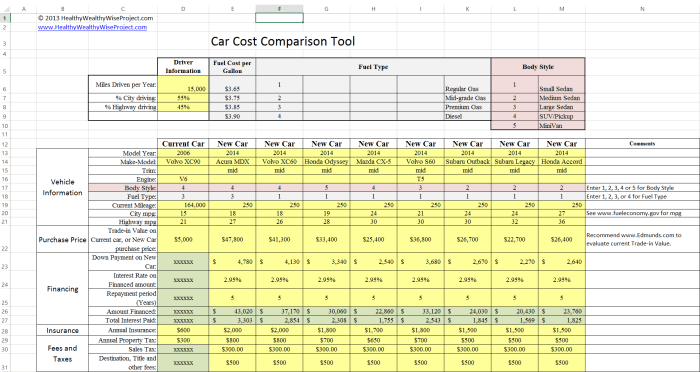

Source: healthywealthywiseproject.com

A new car insurance price calculator serves a crucial function for prospective and current car owners. Understanding the diverse needs and motivations behind user searches for such a tool is essential for designing an effective and user-friendly application.

User Search Intent and Profiles, New car insurance price calculator

Users searching for “new car insurance price calculator” have various reasons, primarily revolving around cost comparison and informed decision-making. We can categorize users into distinct profiles based on their intent.

- First-time car buyers: These users are completely new to car insurance and lack experience in comparing policies. They often seek a quick overview of potential costs before committing to a purchase. User Persona: Sarah, 22, recent college graduate, purchasing her first car. Key concern: Affordability.

- Experienced drivers switching insurers: These users are familiar with car insurance but are looking to find a better deal or improve their coverage. They are price-sensitive and actively compare options. User Persona: John, 35, experienced driver, dissatisfied with current insurer. Key concern: Value for money.

- Drivers renewing their policies: These users are renewing their existing policies and use the calculator to check if their current insurer offers the best price compared to competitors. User Persona: Maria, 45, long-time driver, seeking renewal options. Key concern: Maintaining current coverage at a competitive price.

Before using a price calculator, users typically ask themselves questions such as: “How much will car insurance cost me?”, “What factors influence the price?”, “What coverage options are available?”, and “Which insurer offers the best deal?”.

Essential Features of a Car Insurance Price Calculator

A user-friendly calculator requires several key features to ensure accurate and efficient price estimations. These features directly impact the user experience and the overall usefulness of the tool.

Accurately estimating your new car insurance costs is crucial before purchase. A key factor influencing the final premium is the vehicle’s price, so understanding the invoice price is essential. To determine this, you can utilize resources like this helpful guide on how to find out invoice price on a new car. Knowing the invoice price allows for more precise comparisons when using a new car insurance price calculator, ultimately helping you secure the best rate.

- Intuitive Interface: Clear navigation, simple instructions, and minimal jargon are crucial.

- Comprehensive Data Input Fields: The calculator should request all relevant information, such as vehicle details (year, make, model), driver information (age, driving history, location), and desired coverage levels (liability, collision, comprehensive).

- Multiple Coverage Options: The calculator should allow users to select different coverage levels and see how this impacts the price.

- Real-time Calculations: Instant feedback as the user inputs data enhances the user experience.

- Clear Results Display: Calculated prices should be presented clearly, with a breakdown of costs by coverage type.

- Comparison Feature: Allowing users to compare prices from multiple insurers side-by-side.

Calculator designs should prioritize simplicity and ease of use. A cluttered interface can confuse users and lead to inaccurate inputs. Effective use of white space, clear labeling, and logical grouping of input fields are key design considerations.

Ideal Calculator Interface Mock-up

The following table represents a simplified mock-up of an ideal calculator interface, emphasizing clear and concise data input fields.

| Car Details | Driver Information | Coverage Options | Additional Information |

|---|---|---|---|

| Year: | Age: | Liability: | Zip Code: |

| Make: | Driving History (Accidents): | Collision: | Driving Experience (Years): |

| Model: | Driving History (Tickets): | Comprehensive: |

Data Accuracy and Transparency

Maintaining data accuracy and transparency is crucial for building user trust and providing reliable price estimations. Using accurate and up-to-date insurance rate data is paramount.

- Data Sources: Reliable data sources include direct partnerships with insurance providers, publicly available datasets, and reputable insurance data aggregators.

- Transparency: Clearly stating the data sources used and the calculation methodology builds trust. Displaying a disclaimer regarding potential variations in actual quotes is also important.

- Error Handling: The calculator should gracefully handle unexpected inputs (e.g., invalid dates, non-numeric values) and provide user-friendly error messages.

Presenting Results and Next Steps

Source: adxcms.com

The calculator should present calculated insurance prices clearly and concisely. Multiple price options and coverage levels should be displayed to allow for informed comparisons.

- Clear Display: Use a tabular format to display different price options for various coverage levels.

- Next Steps: Provide clear instructions on how to obtain a formal quote from the insurers listed. Include links to their websites or contact information.

Sample Results (Illustrative):

High-Risk Driver: Estimated annual premium: $2,500 (Basic Coverage), $3,500 (Standard Coverage), $4,500 (Premium Coverage)

Low-Risk Driver: Estimated annual premium: $1,200 (Basic Coverage), $1,800 (Standard Coverage), $2,400 (Premium Coverage)

Visual Representation of Data

Visual representations of data can significantly improve user understanding and engagement. Charts and graphs can effectively communicate complex information in a simple and intuitive manner.

- Bar Chart Example: A bar chart comparing insurance costs for different coverage levels could use the x-axis to represent coverage levels (Basic, Standard, Premium) and the y-axis to represent the cost. Each bar would represent the cost for a specific coverage level. Clear labels for axes and bars are essential.

- Illustrative Descriptions: For example, a description of a chart illustrating the impact of age on insurance premiums might read: “The chart shows a clear downward trend in insurance costs as driver age increases, reflecting the generally lower risk associated with older drivers. Drivers aged 25-35 typically have the highest premiums, while premiums decrease significantly for drivers over 65.”

Addressing User Concerns and FAQs

A comprehensive FAQ section addresses common user concerns and provides helpful information. This proactive approach enhances user satisfaction and reduces the need for external support.

- Common Concerns: Accuracy of estimates, factors influencing prices, differences between quotes, and the meaning of various coverage options.

- FAQ Examples:

- Q: How accurate are these price estimates? A: These are estimates based on current market data. Actual quotes may vary.

- Q: What factors affect my car insurance price? A: Factors include your age, driving history, location, vehicle type, and chosen coverage level.

- Q: Why are there differences between the estimated prices and actual quotes? A: Insurers use different rating models and may consider additional factors not included in this calculator.

Frequently Asked Questions

How accurate are the results from the calculator?

The calculator provides estimates based on the data entered. Accuracy depends on the completeness and correctness of the information provided. Results should be considered approximations and not a final quote.

What if I make a mistake entering my information?

Most calculators allow you to review and edit your input before submitting. Double-check all information for accuracy to ensure a reliable estimate.

What types of coverage are included in the calculations?

The calculator typically offers options for various coverage levels, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The specific options available may vary depending on the calculator’s design.

Can I use this calculator if I’m a new driver?

Yes, most calculators cater to drivers of all experience levels. You’ll likely be asked to provide information about your driving history, even if it’s limited.