How to Get New Car Dealer Invoice Price

Understanding Dealer Invoice Price

How to get new car dealer invoice price – Knowing the dealer invoice price is crucial for effective car buying negotiations. It provides a benchmark against which you can assess the dealer’s offered price and negotiate a fair deal. This section will break down the components of the invoice price, clarify its differences from other pricing structures, and illustrate its influence on the final purchase price.

Dealer Invoice Price Components

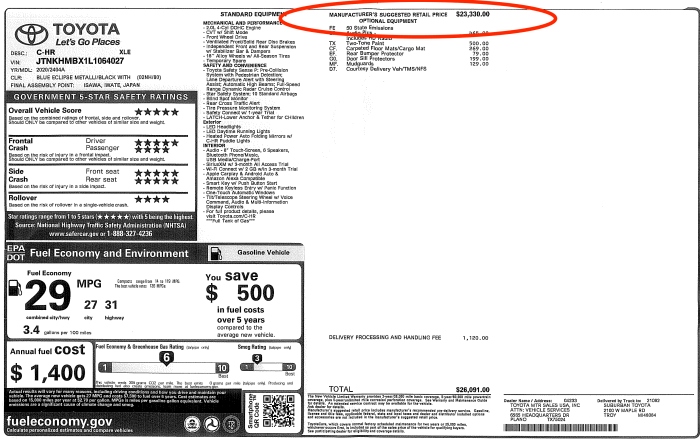

The dealer invoice price isn’t simply the price the dealer paid for the car. It includes several components: the base manufacturer’s suggested retail price (MSRP) of the vehicle, destination charges (covering transportation to the dealership), any manufacturer incentives or rebates (passed on to the dealer), and the dealer’s holdback (a percentage of the MSRP retained by the manufacturer to ensure dealer profitability).

It does not, however, typically include any additional dealer-added packages or options.

Invoice Price vs. MSRP vs. Sticker Price

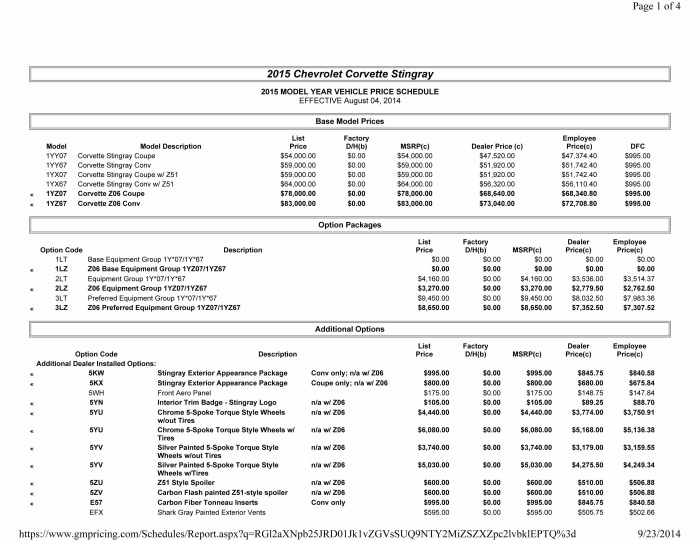

These three prices represent different stages in the car’s pricing journey. The MSRP is the manufacturer’s suggested retail price, often displayed prominently on the vehicle. The sticker price, also known as the Manufacturer’s Suggested Retail Price (MSRP) plus any additional dealer-added options and fees. The invoice price is what the dealer pays the manufacturer, representing the car’s cost to the dealership before adding any profit margin.

For example, let’s consider a hypothetical 2024 Toyota Camry. Its MSRP might be $26,000. The sticker price, with added options and dealer fees, could reach $28,000. The dealer invoice price, factoring in rebates and holdback, might be around $24,000.

Factors Influencing Invoice Price

Source: squidex.io

Several factors influence the invoice price, including manufacturer rebates and incentives (which can fluctuate based on sales targets and seasonality), the vehicle’s popularity and demand (higher demand can sometimes lead to a slightly higher invoice), and the dealer’s negotiating power (larger dealerships may have better negotiating leverage).

Hypothetical Scenario: Price Differences

Source: simpleinvoice17.net

Let’s imagine a hypothetical 2024 Honda Civic. The MSRP is $25,000. The dealer adds $1,500 in options, bringing the sticker price to $26,500. Due to current market conditions and manufacturer incentives, the dealer’s invoice price might be $23,000. This demonstrates a significant difference between the sticker price and the dealer’s actual cost.

Methods to Access Dealer Invoice Price Information

Several resources can help you access dealer invoice price estimates, each with its own advantages and limitations. Understanding these differences is key to making informed decisions during your car purchase.

Comparison of Online Resources

| Resource Name | Accuracy | Cost | Features |

|---|---|---|---|

| Edmunds | High (generally within a reasonable range) | Free (with limitations) / Paid Subscription | Invoice price estimates, reviews, buying guides |

| Kelley Blue Book (KBB) | High (generally within a reasonable range) | Free (with limitations) / Paid Subscription | Invoice price estimates, market value analysis, trade-in value estimates |

| TrueCar | Moderate (can vary based on location and dealer) | Free (with limitations) / Paid Subscription | Invoice price estimates, dealer pricing transparency |

| Consumer Reports | High (relies on extensive data and analysis) | Paid Subscription | Invoice price estimates, reliability ratings, road tests |

Limitations of Free Online Tools

Free online tools often provide estimates rather than precise invoice prices. Their accuracy can vary depending on the specific vehicle, location, and time of year. They may also lack detailed information on specific dealer incentives or holdbacks.

Pros and Cons of Paid Subscription Services

Paid services generally offer more accurate and comprehensive invoice price information. However, they come with a subscription fee. The decision of whether to pay for a subscription depends on how frequently you buy cars and how much value you place on precise pricing information.

Flowchart: Obtaining Invoice Price Information

A flowchart would visually depict the steps: 1. Select a reliable online resource (Edmunds, KBB, etc.). 2. Input the vehicle’s details (year, make, model, trim). 3.

Review the provided invoice price estimate. 4. Verify the estimate by checking multiple resources. 5. Consider the limitations of the estimates and adjust your negotiation strategy accordingly.

Negotiating with the Dealership

Armed with invoice price information, you can approach negotiations with confidence. This section details strategies for leveraging this information and effectively countering common dealer objections.

Effective Negotiation Strategies

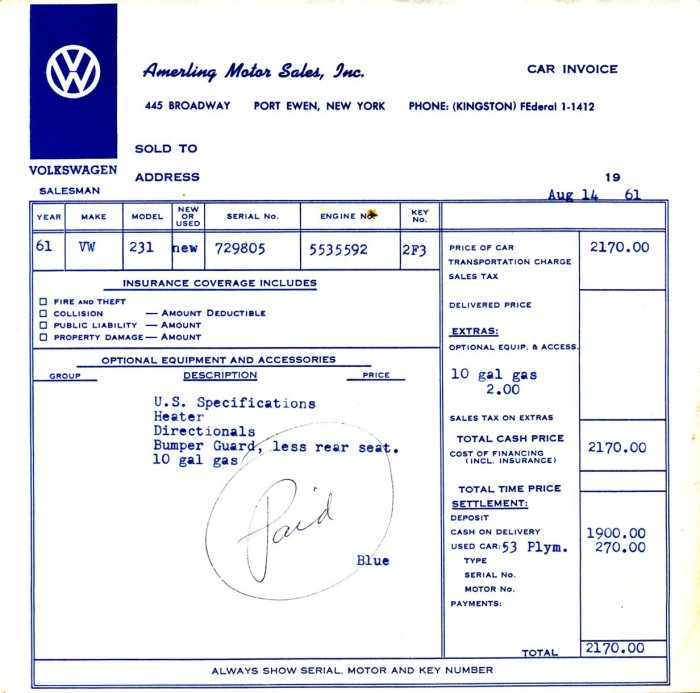

Start by stating your target price, which should be close to or slightly above the invoice price. Be prepared to walk away if the dealer is unwilling to negotiate reasonably. Highlight any manufacturer incentives or rebates to strengthen your position. Always be polite but firm in your negotiations.

Counter-Arguments to Dealer Objections

Dealers might claim the invoice price is inaccurate or that they’re losing money. Counter these by showing them the invoice price from multiple reputable sources. Emphasize that you’re aiming for a fair deal, not to exploit them. Mention that you’re willing to walk away if a fair price cannot be reached.

Importance of Building Rapport

Building a positive relationship with the salesperson can improve your chances of a successful negotiation. Be respectful, listen to their concerns, and treat them fairly. A collaborative approach can lead to a more mutually beneficial outcome.

Step-by-Step Negotiation Guide

Source: thesamba.com

1. Present your research, including the invoice price from multiple sources. 2. State your desired price, justifying it based on the invoice and market conditions. 3.

Listen to the dealer’s counter-offers and address their concerns. 4. Negotiate incrementally, showing willingness to compromise while staying firm on your bottom line. 5. Once an agreement is reached, confirm all details in writing before signing any documents.

Factors Affecting Negotiated Price

While the invoice price is a significant factor, other elements influence the final purchase price. Understanding these factors allows for a more comprehensive negotiation strategy.

Additional Factors Influencing Final Price

Factors beyond the invoice price include trade-in value (negotiate this separately), financing options (interest rates can significantly impact the overall cost), market demand (high demand vehicles allow less negotiation), and vehicle availability (limited inventory strengthens the dealer’s position). A strong credit score can lead to better financing terms and potentially a lower overall price.

Impact of Different Financing Options, How to get new car dealer invoice price

Different financing options (dealer financing vs. external financing) offer varying interest rates and terms. Compare rates from multiple lenders to secure the most favorable financing. A lower interest rate significantly reduces the overall cost of the vehicle over the loan term.

Market Demand and Vehicle Availability

High demand and low availability of a particular vehicle shift negotiation power towards the dealer. Conversely, low demand and high inventory offer greater leverage to the buyer.

Influence of a Strong Credit Score

A strong credit score qualifies you for lower interest rates, reducing the total cost of the vehicle over the loan’s life. It also signals financial responsibility, potentially influencing the dealer’s willingness to negotiate.

Illustrative Examples: How To Get New Car Dealer Invoice Price

Real-world scenarios highlight the effectiveness of leveraging invoice price information and the impact of various negotiation strategies.

Successful Negotiation Using Invoice Price

Let’s say the invoice price for a specific vehicle is $22,000. The buyer, armed with this information from multiple sources, aims for $23,500. After negotiations, the buyer secures the vehicle at $23,800. This demonstrates successful leverage of invoice price information to achieve a favorable price. The dialogue might involve the buyer presenting the invoice price, highlighting market conditions, and remaining firm yet polite throughout the negotiation.

Visual Representation of Price Breakdown

A visual representation would show a bar graph. The longest bar represents the sticker price ($26,500). A shorter bar representing the invoice price ($22,000) is placed underneath. The difference between the two represents the dealer’s markup. Additional smaller bars could show the impact of financing costs, trade-in value, and any negotiated discounts.

Securing a new car’s dealer invoice price can be tricky, but understanding the underlying calculations is key. To effectively negotiate, you need to know how the dealer’s cost is determined, and a helpful resource for this is learning how to calculate invoice price yourself, which you can find out more about at how to calculate invoice price of a new car.

Armed with this knowledge, you’ll be better equipped to approach negotiations and potentially secure a more favorable price from the dealer.

Unsuccessful Negotiation Without Invoice Price

In a scenario where the buyer doesn’t use invoice price information, they might end up paying the sticker price or even more due to a lack of leverage. The analysis would highlight the missed opportunity to secure a more favorable price and emphasize the importance of pre-negotiation research.

Negotiation When Invoice Price is Unavailable

If the invoice price is unavailable, the buyer can still negotiate by focusing on market prices from comparable vehicles, highlighting any manufacturer incentives, and emphasizing the importance of securing a fair price based on competitive market data. They could also research the dealer’s average markup to estimate a reasonable offer.

General Inquiries

What if the dealer refuses to disclose the invoice price?

While dealers aren’t obligated to share their invoice price, you can still negotiate using publicly available price estimates from reputable online resources. Focus on the market value of the vehicle and comparable deals.

How important is my credit score in negotiations?

A strong credit score can significantly impact your financing options and potentially lower your interest rate, indirectly reducing the overall cost of the vehicle. A lower interest rate can be as beneficial as a lower purchase price.

Can I negotiate the price even if I’m financing through the dealership?

Yes, negotiating the purchase price and the financing terms are separate processes. Negotiate the best possible price first, then discuss financing options.

What if I don’t have a trade-in?

Not having a trade-in doesn’t hinder your negotiation power. Focus on the vehicle’s market value and the invoice price to build a strong negotiation position.